Unlock the Advantages: Why You Need a NY Estate Planning Lawyer Today!

Why You Should Consider an Estate Planning Attorney In today’s digital world, the allure of handling complex tasks independently is stronger than ever.With just a few clicks,you can access online templates for nearly any document,including legal ones like a Last Will and Testament.The appeal is clear: save money, save time, and manage your affairs from […]

Essential Estate Planning Documents for New Yorkers

Your Guide to Essential Estate Planning Documents in NY Embarking on the estate planning process can feel like navigating a dense forest of legal jargon and complex choices. Many New Yorkers know they need a “plan,” but they are unsure what that actually entails. What specific documents form the foundation of a secure future for […]

Totten Trust NY: A Simple Estate Planning Tool Explained

What Is a Totten Trust? An Expert Guide for New Yorkers In the world of estate planning, individuals often seek straightforward methods to transfer assets to loved ones, hoping to avoid the complexities and costs of probate. You may have a savings account that you want to go directly to a child or grandchild upon […]

Expert Legal Guidance for Your Wills and Trusts Needs

“`html Mastering Estate Planning: The Importance of Expert Lawyers in New York Developing a thorough estate plan is essential for safeguarding your assets, ensuring your loved ones are cared for, and making sure your intentions are respected.In New York, navigating the intricacies of wills and trusts necessitates the expertise of seasoned legal professionals. “Lawyers specializing […]

Safeguarding Your Legacy: How Morgan Legal Group Empowers Families

“`html Legacy of Dedication and Family Security: The Morgan Legal Group Narrative At the heart of Morgan Legal Group lies a profound understanding that estate planning transcends mere legalities and financial tactics. It embodies the safeguarding of one’s legacy, upholding cherished values, and ensuring familial security for future generations. Our firm’s ethos is deeply rooted […]

Success From The Journey

From Refugee to Legal Pioneer: Russel Morgan’s Journey of Resilience and Success – A Comprehensive FAQ At Morgan Legal Group P.C., we are so proud of how our business came to be, and what we have made for clients just like you! The main goal and to start from the ground to make something of […]

Unlocking the Mysteries of Probate Litigation: What You Need to Know

Expert Insights on Probate Litigation in New York from Morgan Legal Group Experiencing the loss of a loved one is tough, and managing their estate can add to the burden. Morgan Legal Group, located in New York City, specializes in probate services to assist you with the legal intricacies of asset administration. Whether you’re an […]

Unlocking Your Legacy: The Power of Wills and Trusts

Navigating Estate Planning in New York: A Guide to Wills and Trusts Welcome to Morgan Legal Group P.C.,your reliable partner for expert advice on estate planning,including Wills and Trusts,in New York.Ensuring every detail is meticulously planned is crucial. This guide delves into the essential elements of wills and Trusts, their importance, distinctions, and how our […]

Top Brooklyn Attorney: Mastering Estate Planning and Probate

Finding the Right Estate Planning and Probate Lawyer in Brooklyn,NY: Essential Advice for Your Family’s Future Welcome to Morgan Legal Group P.C., your reliable partner for estate planning and probate services in Brooklyn, New York. Our committed team recognizes the importance of safeguarding your assets and ensuring a smooth transfer of your estate to your […]

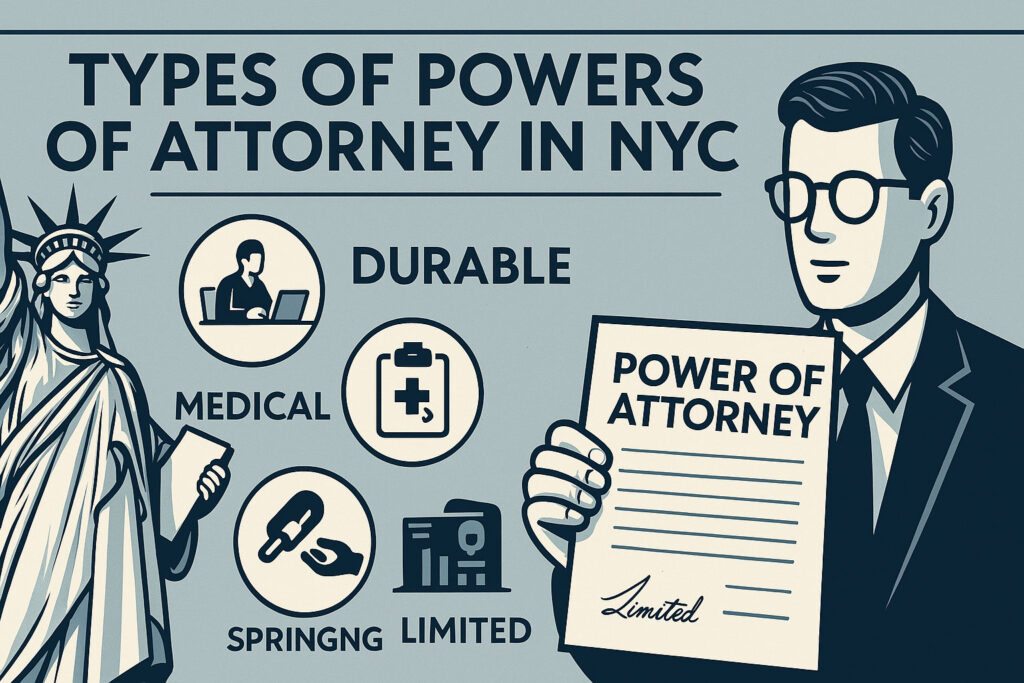

NYC Power of Attorney

NYC Power of Attorney: A Complete Guide to Protecting Your Future In the bustling city of New York, planning for the unexpected is crucial. A Power of Attorney (POA) is a legal document that allows you to appoint someone you trust to act on your behalf in financial and/or medical matters if you become unable […]