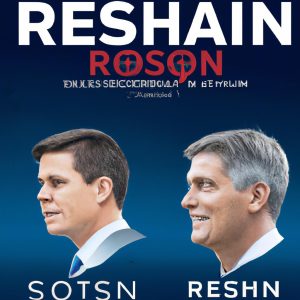

Texas House Speaker Faces High-Stakes Runoff Against Trump-Backed Challenger

<div><div>Texas House Speaker Race: A New Chapter Unfolds</div> <p>In an unexpected twist, the Texas House Speaker Dade Phelan and his Republican opponent David Covey, who has the backing of former President Donald Trump and Attorney General Ken Paxton, are gearing up for a primary runoff in May, according to projections by The Associated Press.</p> <div>Significance of the Runoff</div> <p>This surprising development in the Texas House Speaker race carries substantial implications for the state’s future leadership. With both candidates competing for the Republican nomination, the outcome of this primary runoff will significantly influence Texas politics for the foreseeable future.</p> <div>Candidate Profiles</div> <p>Dade Phelan, the current Texas House Speaker, is recognized for his moderate stance and his ability to collaborate across party